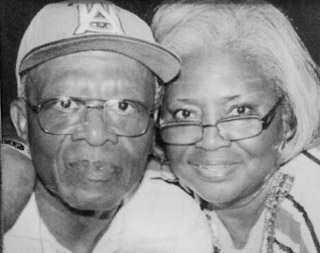

Annie Roscoe’s husband has lived in the same house in Bessemer, AL since he was born, he is now 70-years-old. In 2002, the Roscoes were catapulted into a long and stressful journey, which appeared destined to cost them their home. “My husband got sick, he had a couple of strokes, at least five mini-strokes when they found out what was wrong with him,” Roscoe said. “So we had to wait until his money got started, and we got behind on our mortgage.”

In 2004, Roscoe’s husband took out $20,000 from his retirement plan as a department of transportation engineer, and used $10,000 to catch up on his mortgage payments. The Roscoes believed they were caught up and could go back to making their regular payments, when yet another unexpected event left them searching for answers.

In 2004, Roscoe’s husband took out $20,000 from his retirement plan as a department of transportation engineer, and used $10,000 to catch up on his mortgage payments. The Roscoes believed they were caught up and could go back to making their regular payments, when yet another unexpected event left them searching for answers.

“After that, the mortgage company disappeared. I don’t know what happened to them; all of a sudden our loan was sold to so many people. I can’t send people money I don’t know anything about; it went on for years and years and years. All of a sudden we got a letter from a new mortgage company, after almost 10 years of trying to find out where our loan was,” said Roscoe. “That’s when they said we owed a hundred and some thousand dollars on our mortgage, and I said, ‘this is crazy’. We only got a $50,000 loan. It’s not our fault that the company, I don’t know if it folded or they got all the money they wanted to get, we don’t know anything about what happened to them.”

The Roscoes tried to work with the new mortgage company to modify their loan, but they had no success and were required to make monthly payments of $700, which was an unmanageable amount for them. So Annie sent all she could, $400 each month, but they still told her she was going to lose her house. The Roscoes sought help from the attorney general and still had no success modifying their loan. They eventually told their lender that they could not pay anymore. “You do what you have to do and I’m going to do what I have to do.” Roscoe told her lender. “This is ridiculous, you all are not working with people, you are taking people’s homes, if you want this one, you’re going to have to fight for it.”

Just when Roscoe had reached her breaking point and taken her final stand with her lender, she received a letter in the mail stating that American Homeowner Preservation (“AHP”) had purchased their loan, offering to settle her delinquent interest payments for $2,000 and reset her monthly payments to $250. Roscoe was hesitant, but once she called and talked to AHP’s CEO Jorge Newbery, she was ecstatic.

“I felt like I was sitting on cloud 29! It made me so happy to know that there is somebody out there to help people that are trying to keep their homes, because so many people don’t care; they’ll do whatever they can to get your house. Mr. Newbery was so nice- it was like a breath of fresh air. It just took a burden off us. We can stay in our home, we can live comfortably, and not worry about our mortgage ending up in someone else’s hand.”

Real estate crowdfunding is expanding AHP’s ability to assist homeowners like the Roscoes. Without this innovative platform, success stories like theirs would be fewer and farther between. This pioneering investment model is still in the early stages, yet according to a recent poll conducted by GlobeSt.com, more and more people are buying into its legitimacy.

The poll found that 31 percent of respondents said they feel real estate crowdfunding is a legitimate form of real estate fundraising, but only for certain types of deals. Twenty-three percent also felt it was legitimate, but “only after heavily vetting the crowdfunding platforms”. Thirty percent said they don’t find real estate crowdfunding to be legitimate now, but believe it will be in the future, and 16 percent said they think it will never be a legitimate way to fundraise.

This poll indicates that while there is still a certain amount of skepticism in the public’s evaluation of real estate crowdfunding, it is definitely carving out its own space in the investment world. Crowdfunding is a great way to even the playing field and allow more people to invest in real estate that otherwise might never have been able to. The technology available today has made this process so easy that people can research and execute their investments without ever leaving their homes, while also having the ability to choose investments they deem to be both socially responsible and financially sound. Further, crowdfunding creates a more transparent relationship between issuer and investor. It is a win-win-win-win situation for the issuers, investors, families and communities.

Through stories like the Roscoe’s, skepticism surrounding this new model may dissipate and more people will consider the social impact of their investments, alongside the financial rewards. Mrs. Roscoe said that she knows many people who lost their homes while she was fighting to keep hers. She is grateful for the assistance AHP provided her in a time of need and hopes more people can share her experience.

“I thank you all, I appreciate you all, and I just hope you can continue to help other people,” Roscoe said. “People shouldn’t have to lose their homes because of companies that want to take advantage of them, it’s just not fair. I wish other people could have had a chance to keep their homes.”

440 S LaSalle Street, Suite 1110, Chicago,IL 60605

440 S LaSalle Street, Suite 1110, Chicago,IL 60605